I did initially creatre it as a Liability but when I use the "Spend Money" function or the Bank Register, it will not let me record transactions against this account unless I make it a Credit Card?

I am hoping someone can help as I am sure this is a very basic and simple thing!

Thanks, Cheryl

Solutions

Hi Cheryl Yes that is the type of account I would use "Director's Loan Liability Account under Other Liabilities" because the company owes you money.

If you owed the company money then the Director's Loan Account would appear under Assets.

To enter the business purchases raise a general journal entry. Debiting the relevant Expense Accounts and Crediting the Director's Loan Liability Account.

If your company is registered for GST then don't forget to allow for the gst on the expense accounts if there is any.

Hope this helps

Geoff Busselton Bookkeeping Service MYOB Certified Consultant, BAS Service Provider Phone 08 9754 7680 www.busseltonbookkeeping.com.au

Ref: http://community.myob.com/t5/AccountRight-Getting-started/Directors-Loan-How-to-set-up-for-business-expenses-from-personal/td-p/45379

https://caseron.co.uk/directors-loan-account/

What is Drawings and its Journal Entry (Cash, Goods)?

Drawings

Assets in the form of Cash or Goods withdrawn from a business by the owner(s) for their personal use are termed as drawings. It reduces capital invested in the business by the owner(s) and if goods are withdrawn, they are valued at cost price. If a business is incorporated, they are usually seen in the form of dividends or scrip dividends.

Journal Entry for Drawings in Cash or Goods

| Drawings A/C | Debit |

| To Cash (or) Bank A/C (In case of Money) | Credit |

| To Purchases A/C (In case of Goods) | Credit |

It is a temporary account which is cleared at the end of each accounting year and is not shown as a business expense. Debit balance in the drawing account is closed by transferring it to the capital account. It does not directly affect the profit and loss account in any way.

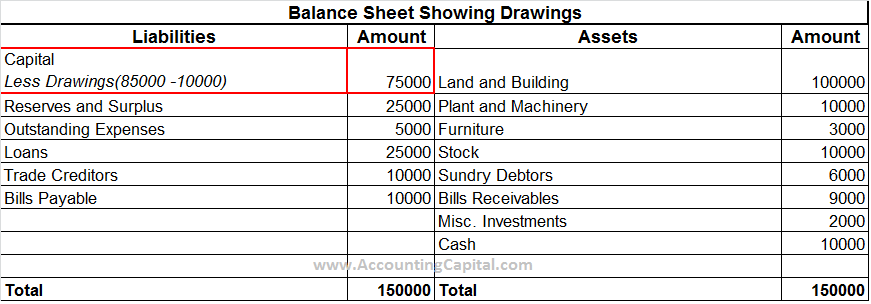

It is a Personal A/C which is reduced from the capital. It is shown in the balance sheet on the liability side as a reduction in capital.

Ref: https://www.accountingcapital.com/basic-accounting/drawings/

Is the drawing account a capital account?

The drawing account will have a debit balance for two reasons. First the draw or withdrawal by the owner reduces the capital account. Second, because each transaction involves a debit and a credit, and because a withdrawal of cash requires a credit to the Cash account, the owner's drawing account will need a debit for the same amount.

At the end of the accounting year, the debit balance in the drawing account is closed by transferring the debit balance to the owner's capital account.

0 comments:

Post a Comment